Translate Cybersecurity Into Business Language

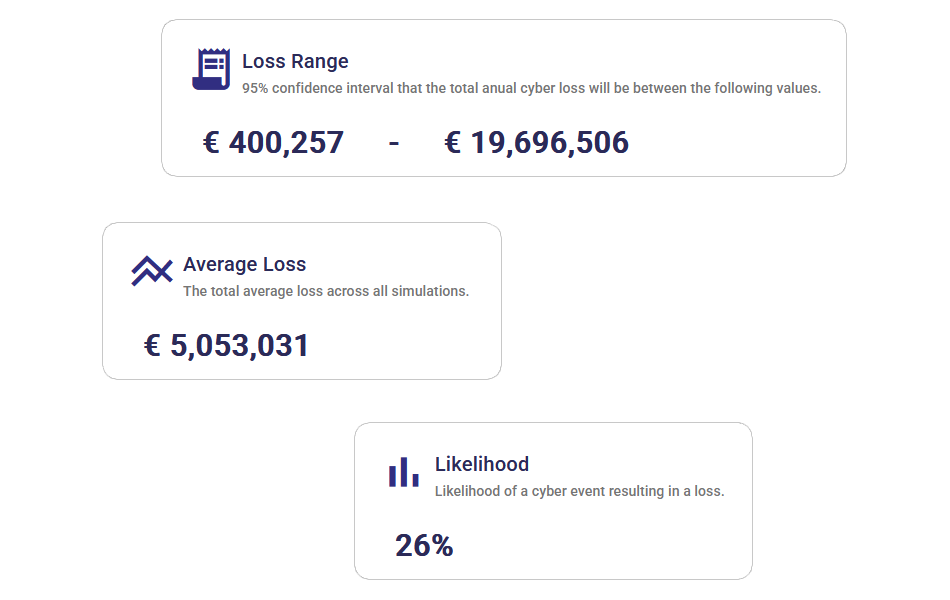

Communicate cyber risk with confidence and simplify regulatory compliance by financially explaining cyber risk exposure and relative business impact.

Get a Demo

Communicate cyber risk with confidence and simplify regulatory compliance by financially explaining cyber risk exposure and relative business impact.

Get a Demo

Equip the board with financially data-driven insights into cyber risk exposure and relative business impact.

Define cyber loss thresholds, streamline materiality and significance determinations, and meet evolving global cyber regulatory requirements.

Simplify regulatory compliance by quantifying cyber risk and provide financially backed insights and reports to the board.

Automation at scale.

Fully integrated into the product

Mathematically justified simulations.

Learn more about some of the relevant product features.

Are you wasting your presentations on heatmaps that nobody understands, or are you driving strategic financial decisions?

Move beyond subjective 'High/Medium/Low' charts to defensible dollars/euros.

Learn how to define 'materiality' with financial precision for regulators.

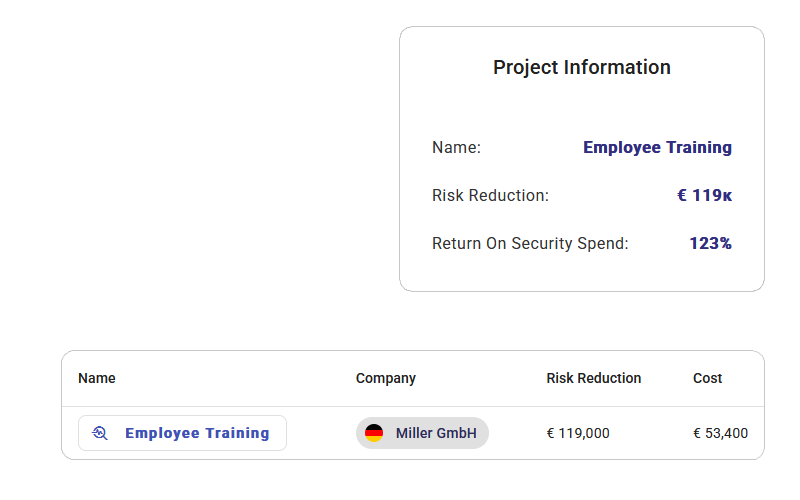

Prove the ROI of your program before the next cost-cutting cycle begins.

Start today and transform the way your company views cyber risk!