Track, Translate, and Optimize Cyber Insurance

Leverage data-backed likelihoods and detailed insurance loss impact scenarios to work with insurance providers and consult your clients according to their unique risk profile.

Get a Demo

Leverage data-backed likelihoods and detailed insurance loss impact scenarios to work with insurance providers and consult your clients according to their unique risk profile.

Get a Demo

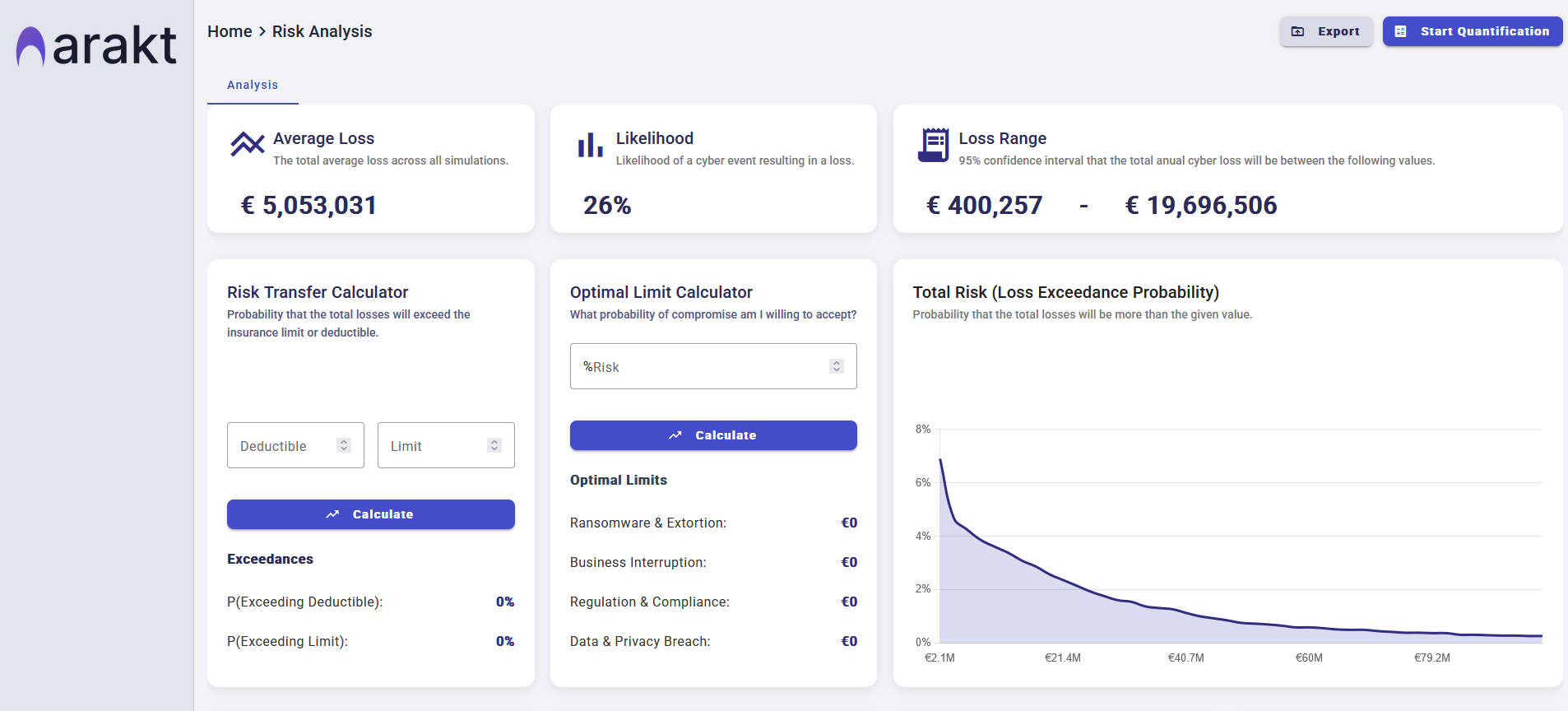

All the features you need for strategic cyber risk management.

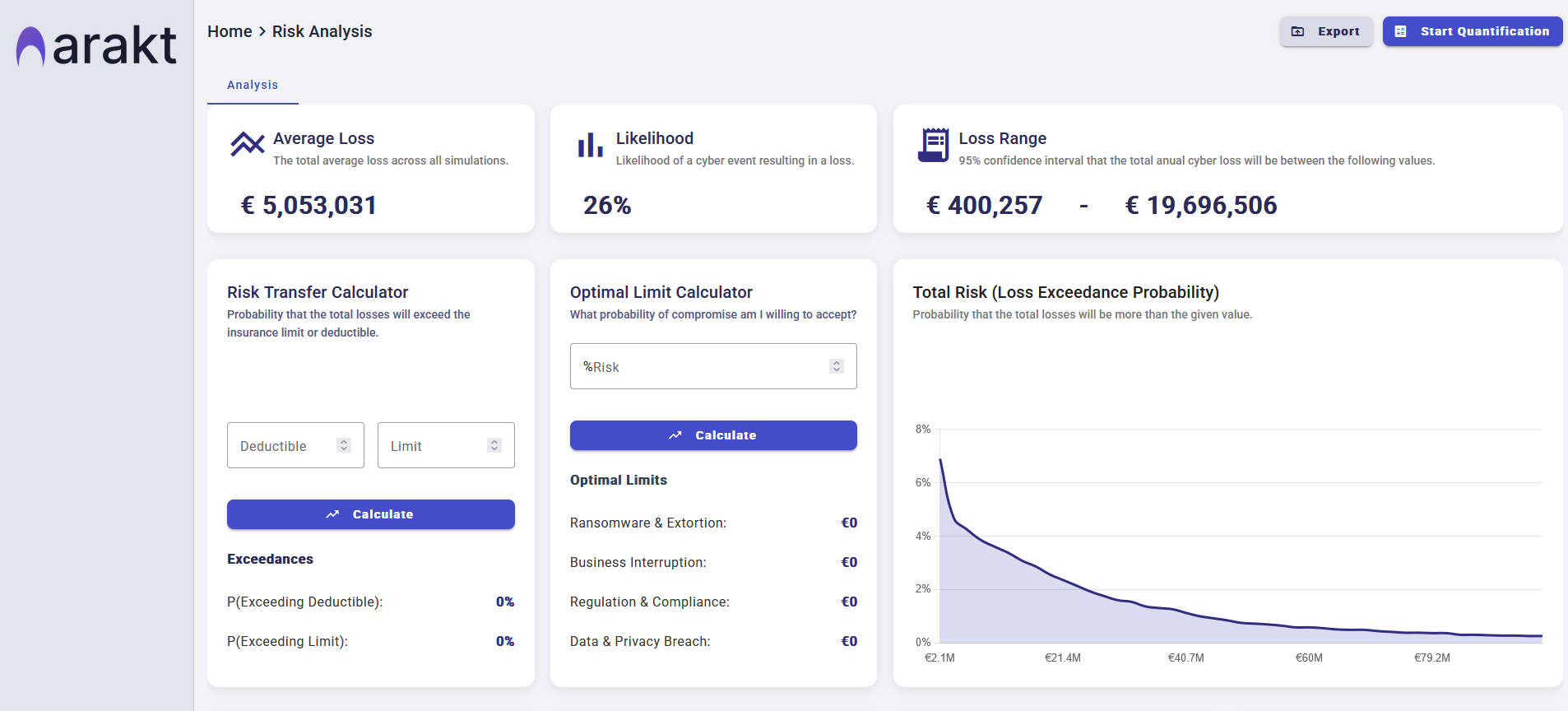

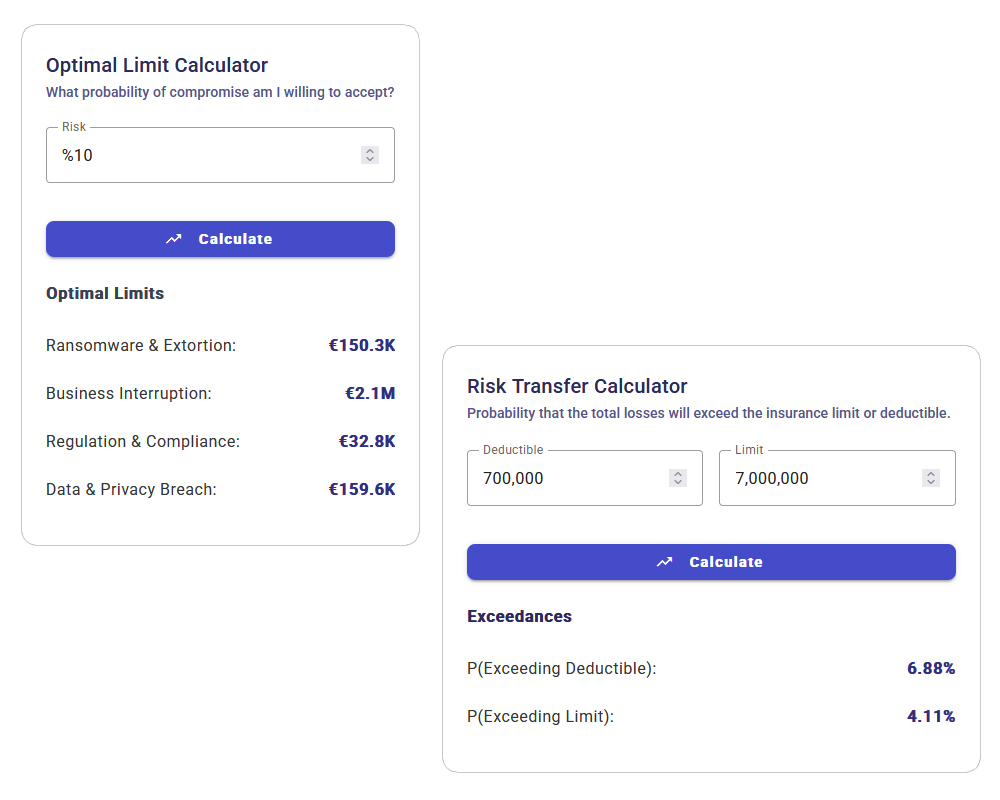

Our dynamic Loss Exceedance Curves illustrate the probability of incurring losses exceeding various thresholds, providing a clear financial context for insurance decisions.

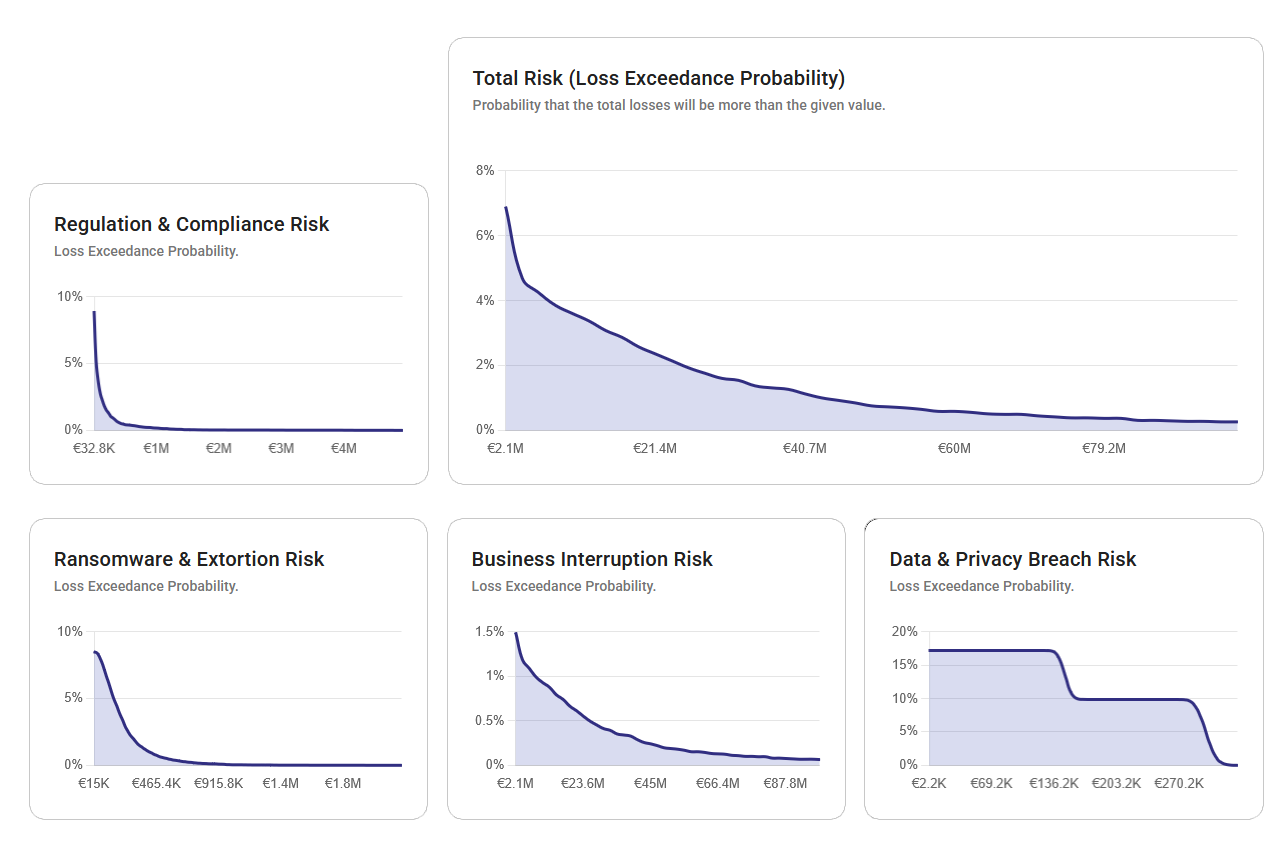

Utilize our advanced calculator to determine the most cost-effective and appropriate cyber insurance limits and deductibles for your organization.

Discover how Arakt Cyber Insurance can help you.

Data-backed evidence of risk posture for potentially lower premiums.

Avoide under-insurance or wasteful over-insurance.

Automate the generation of reports and insights required by insurers.

Start today and transform the way your company views cyber risk!

Learn what else the platform can do.

Take a look at the following knowledge hub resources for an even better understanding of each topic.